Decoding the Cost of Coverage: A Comprehensive Guide to Car Insurance Prices in Toronto

Related Articles: Decoding the Cost of Coverage: A Comprehensive Guide to Car Insurance Prices in Toronto

Introduction

With great pleasure, we will explore the intriguing topic related to Decoding the Cost of Coverage: A Comprehensive Guide to Car Insurance Prices in Toronto. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Decoding the Cost of Coverage: A Comprehensive Guide to Car Insurance Prices in Toronto

Toronto, a bustling metropolis with a diverse population and a complex transportation network, presents a unique landscape for car insurance pricing. Understanding the factors that influence these costs is crucial for drivers seeking affordable and comprehensive coverage. This article delves into the intricacies of car insurance pricing in Toronto, providing a detailed analysis of the factors that shape premiums and offering insights into navigating this complex system.

Understanding the Factors that Shape Car Insurance Costs

Car insurance premiums are not a one-size-fits-all proposition. They are determined by a multitude of factors, each playing a crucial role in calculating the final cost.

1. Vehicle Type and Value:

The type and value of your vehicle significantly impact your insurance premium. High-performance vehicles, luxury cars, and newer models are generally associated with higher repair costs and increased risk of theft, resulting in higher insurance premiums. Conversely, older, less expensive vehicles typically have lower insurance costs.

2. Driving History and Risk Profile:

Your driving history plays a pivotal role in determining your insurance premium. A clean driving record with no accidents, traffic violations, or claims will generally lead to lower premiums. Conversely, drivers with a history of accidents, speeding tickets, or DUI convictions will face higher premiums due to their increased risk profile.

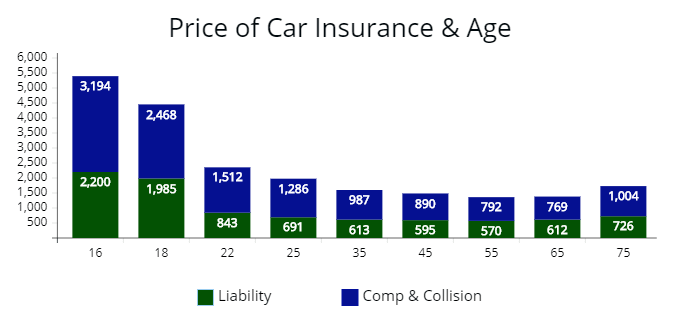

3. Age and Gender:

Statistics show that younger and inexperienced drivers are more likely to be involved in accidents. Consequently, insurance companies typically charge higher premiums to younger drivers. Gender also plays a role, with men often paying higher premiums than women, reflecting historical trends in accident rates.

4. Location and Usage:

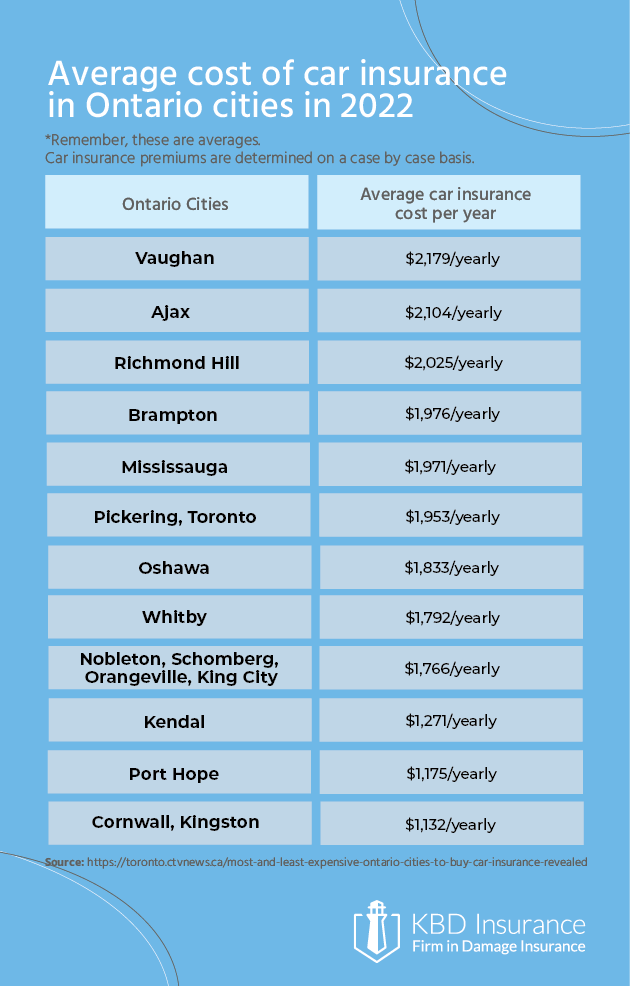

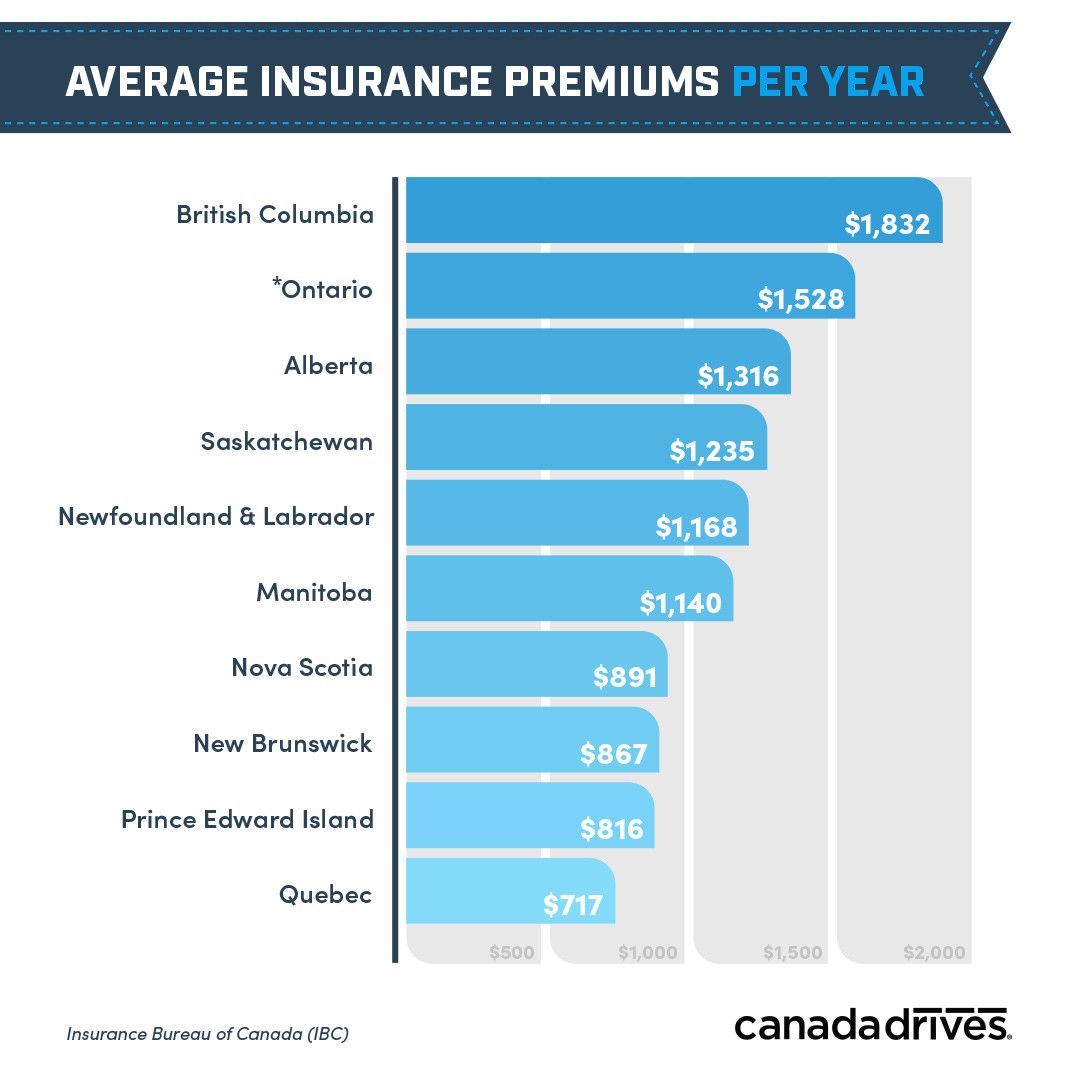

Where you live and how you use your vehicle also influence your insurance costs. Urban areas like Toronto, with higher traffic density and increased risk of accidents, tend to have higher insurance premiums compared to rural areas. Similarly, drivers who use their vehicles for commuting or business purposes often pay higher premiums than those who use their vehicles primarily for personal use.

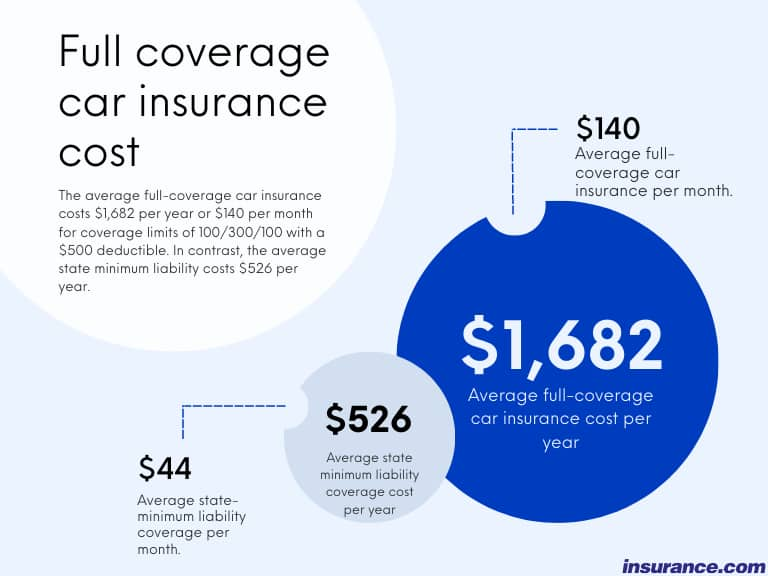

5. Coverage Levels and Options:

The type and level of coverage you choose significantly impact your insurance premium. Comprehensive coverage, which protects against damage caused by non-collision events like theft or vandalism, will be more expensive than liability coverage, which primarily covers damage to other vehicles or property. Adding additional features like collision coverage or uninsured motorist protection will also increase your premium.

6. Credit Score:

In some jurisdictions, including Ontario, insurance companies may use your credit score as a factor in determining your insurance premiums. This practice is based on the theory that individuals with good credit are more financially responsible and less likely to file claims. However, this practice has been subject to debate and criticism, with some arguing that it unfairly penalizes individuals with limited credit histories or those who have faced financial hardship.

Navigating the Complexities of Car Insurance in Toronto

Given the numerous factors influencing car insurance premiums, navigating this complex system can be daunting. Here are some strategies to help you find affordable and comprehensive coverage:

1. Compare Quotes from Multiple Insurers:

Do not settle for the first quote you receive. Contact multiple insurance companies and compare their rates and coverage options. Online comparison tools can simplify this process, allowing you to quickly compare quotes from various insurers.

2. Consider Bundling Your Policies:

Bundling your car insurance with other policies, such as home insurance or renters insurance, can often lead to discounts. Insurance companies offer discounts for multiple policyholders, recognizing the reduced risk associated with bundling.

3. Explore Discounts and Incentives:

Insurance companies offer various discounts and incentives to encourage safe driving and responsible behavior. These discounts can include:

* **Safe Driving Discounts:** Reward drivers with clean driving records and no accidents.

* **Good Student Discounts:** Offer lower premiums to students who maintain a certain GPA.

* **Anti-theft Device Discounts:** Provide discounts for vehicles equipped with anti-theft devices.

* **Loyalty Discounts:** Reward long-term customers with lower premiums.4. Maintain a Good Driving Record:

The most effective way to reduce your insurance premiums is to maintain a clean driving record. Avoid speeding tickets, traffic violations, and accidents, as these incidents will significantly increase your premium.

5. Consider Increasing Your Deductible:

Raising your deductible, the amount you pay out-of-pocket before insurance coverage kicks in, can often lead to lower premiums. This strategy can be particularly beneficial for drivers with a good driving record and a lower risk profile.

6. Review Your Policy Regularly:

Review your insurance policy annually to ensure that your coverage levels are still appropriate and that you are taking advantage of all available discounts. Your insurance needs may change over time, so it is essential to stay informed and make adjustments as required.

7. Seek Professional Advice:

If you are struggling to understand the complexities of car insurance or are unsure about the best coverage options, consider seeking professional advice from an insurance broker. They can provide personalized guidance and help you find the most suitable and affordable coverage for your needs.

FAQs about Car Insurance in Toronto

1. How do I find the best car insurance rates in Toronto?

The best way to find the most competitive car insurance rates is to compare quotes from multiple insurers. Utilize online comparison tools or contact insurance companies directly to obtain quotes and compare their coverage options and pricing.

2. What are the minimum car insurance requirements in Ontario?

Ontario law requires all drivers to have at least the following minimum coverage:

* **Third-Party Liability:** Covers damage to other vehicles or property.

* **Direct Compensation Property Damage (DCPD):** Covers damage to your own vehicle in a collision.

* **Accident Benefits:** Provides benefits for medical expenses and lost income following an accident.3. How can I get a discount on my car insurance?

Several discounts are available to reduce your car insurance premium. Explore options like safe driving discounts, good student discounts, anti-theft device discounts, and loyalty discounts.

4. What happens if I get into an accident without insurance?

Driving without insurance is illegal in Ontario and carries severe consequences. You could face fines, license suspension, and even jail time. You will also be responsible for all costs related to the accident, including damage to other vehicles and property, medical expenses, and legal fees.

5. How do I file a car insurance claim in Ontario?

Contact your insurance company as soon as possible after an accident. Provide them with the necessary details, including the date, time, location, and parties involved. They will guide you through the claim process and assist you with the necessary documentation.

Conclusion: Navigating the Path to Affordable Coverage

Car insurance is a critical aspect of responsible driving, providing financial protection in the event of an accident or other unforeseen circumstances. Understanding the factors that influence car insurance premiums in Toronto is essential for drivers seeking affordable and comprehensive coverage. By comparing quotes, exploring discounts, maintaining a good driving record, and staying informed about policy options, drivers can navigate the complexities of car insurance and find the most suitable coverage for their needs. Remember that seeking professional advice from an insurance broker can be invaluable in navigating this complex system and securing the best possible coverage for your individual circumstances.

Closure

Thus, we hope this article has provided valuable insights into Decoding the Cost of Coverage: A Comprehensive Guide to Car Insurance Prices in Toronto. We appreciate your attention to our article. See you in our next article!